25% discount for QBE policy holders

Less than a quid per vehicle, per week

with

Start your 60 day free-trial

Simply complete the online registration and our team will let you know when your account has been activated

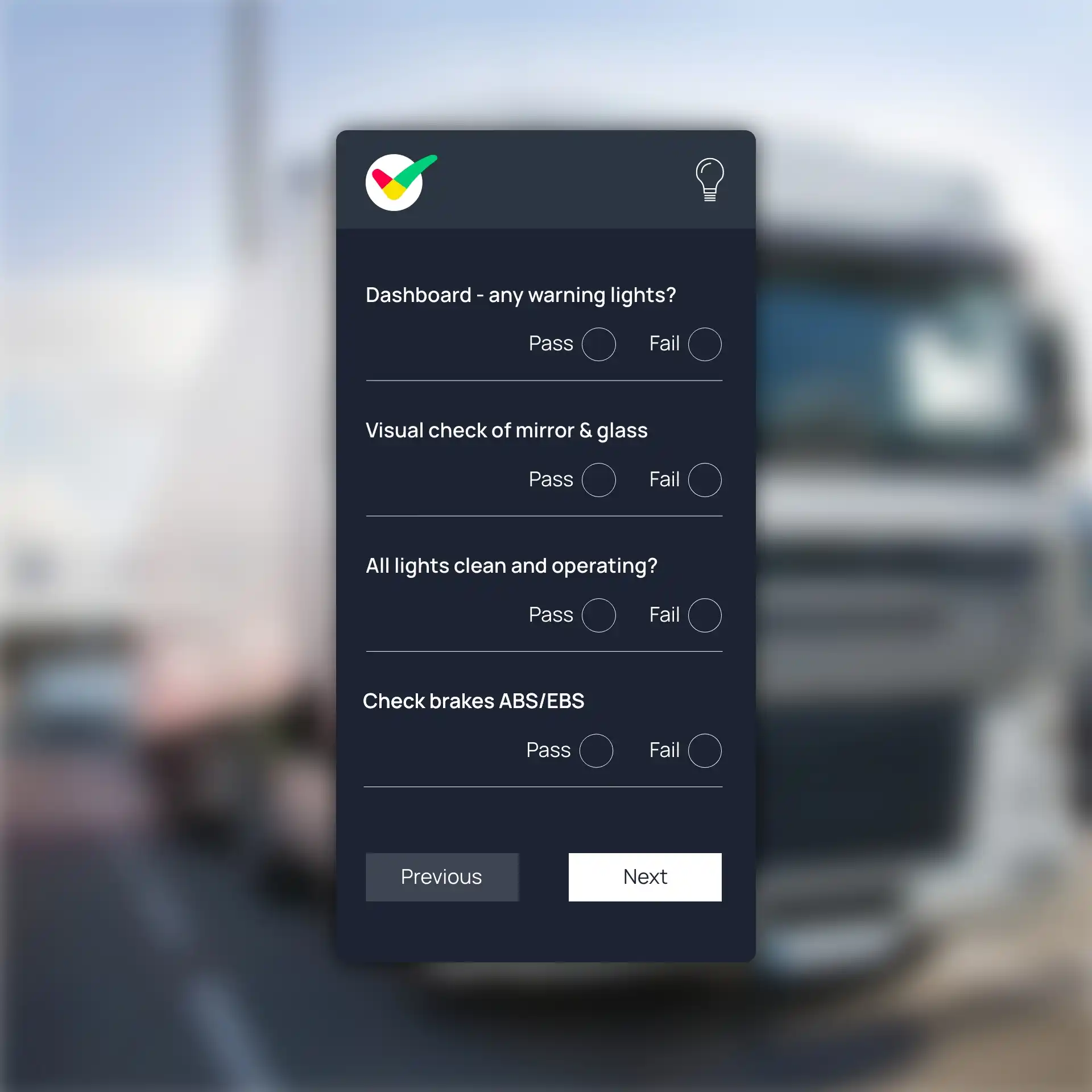

For the drivers

Mobile defect reporting

Compatible with iOS and Android systems, our app features an intuitive, user-friendly interface, allowing drivers to conduct vehicle walkaround checks with ease.

Comprehensive, customised checklist

Tap, check and go

Offline reporting capability

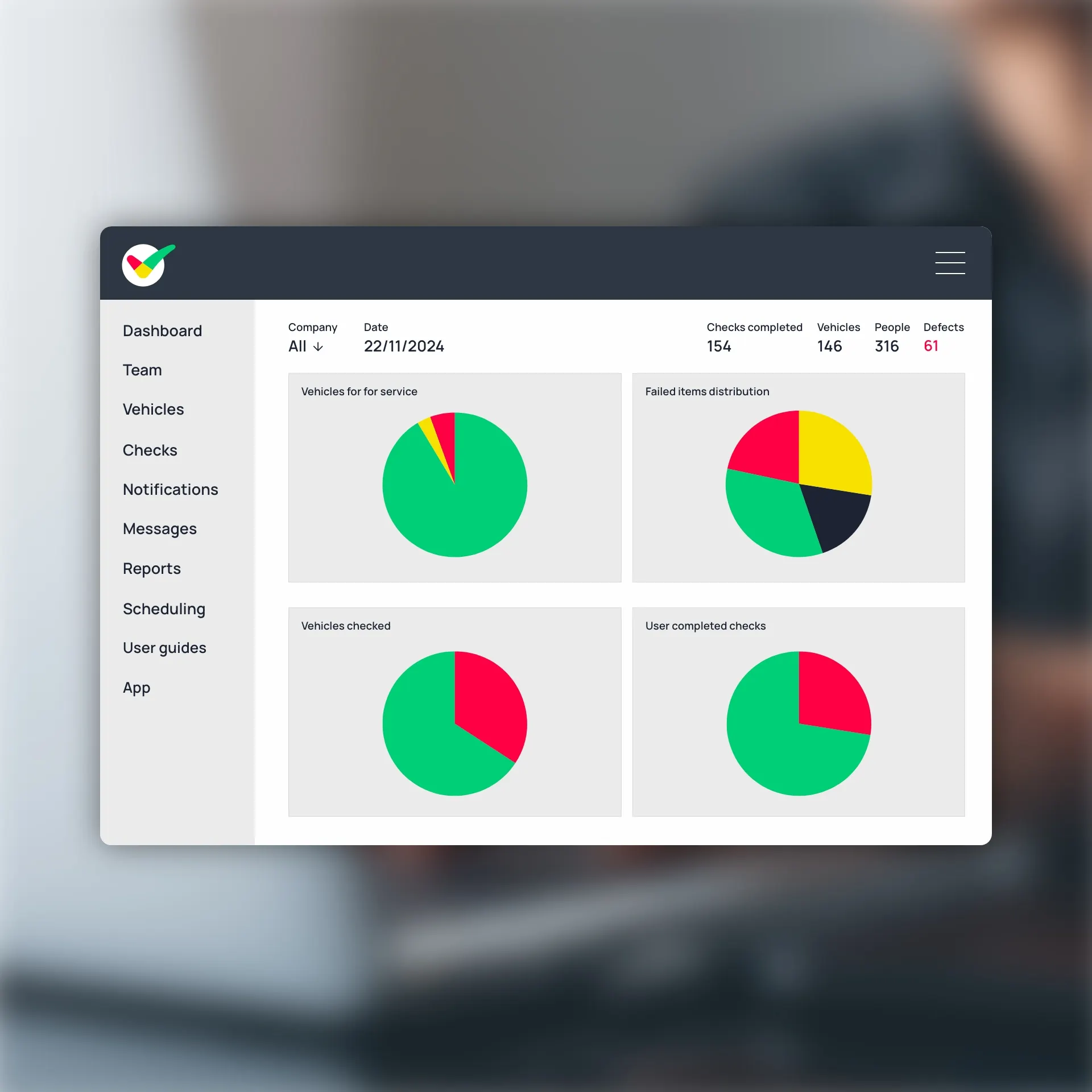

For the office

Complete fleet management

Monitor user activity, view comprehensive maintenance reports in real time, identify outstanding tasks and vehicle defects, and schedule services to remain fully compliant.

Detailed reports for each vehicle and user

Access data in real time

Full audit trail and complete visibility

DVSA Earned Recognition

Our software is fully compliant with the DVSA Earned Recognition scheme, enabling you to prove with ease that your vehicles, drivers, and operations meet all necessary standards, and reducing the likelihood of your vehicles being stopped for roadside inspections.

What are the benefits to

QBE Insurance policy holders and underwriters

A compliant fleet is a safe fleet and accordingly a better risk. All underwriters want a better risk!

CheckedSafe will do all the admin and support with the policyholder. NO extra work for underwriters

No cost to QBE. CheckedSafe has been discounted to incentivise policyholders to use the compliance and reporting solution

Unlike other app’s used to collect data, since drivers are using this system daily (it is legally required to carry out the mandatory daily walk round check) there is familiarity for the Electronic Accident Bump Card

All data collected available to underwriters as part of the agreement between CheckedSafe & Policyholder. A condition of the 25% discount

Reports of accidents can be sent directly to FMG with a hyperlink at the end of each checklist to call FMG or anyone else

Can dual brand as required

Can dual brand as required